Money order services

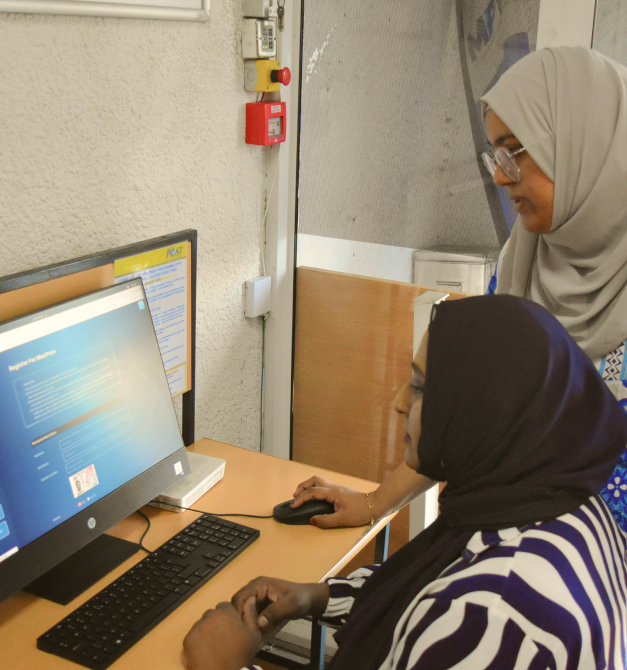

Secure and convenient money transfers

Convenient transactions and account services

Inland postal money order (IPMO)

IPMO is designed for transferring cash to individuals. government bodies, banks, companies, business firms, prisons, rehabilitation centers, and Attorneys’ Chambers within Mauritius, Rodrigues, and Agalega.

Key details for Inland Postal Money Orders

Maximum amount

Easily transfer up to Rs 3,000 per money order.

Minimum amount

Money orders start at Rs 100, with applicable commission fees.

Payee authorization

If the payee can't attend in person, they can authorize someone to cash the money order with an endorsement.

Proof of identity

Both the authorized person and the receiver must provide proof of identity for cashing the money order.

Thumbprint verification

Uneducated payees must use a thumbprint and have a witness sign the money order.

Crossed order deposits

Crossed money orders need to be lodged into a bank account.

Claim liability

Once a money order is paid, no further claims can be made against Mauritius Post.

Late presentation fees

Fees apply for orders presented three months after issuance, with an additional fee for those presented up to 24 months later. Orders presented after 6 months require Mauritius Post's authorization and payment of a fee equal to the original commission.

Electronic money transfer (EMT) - domestic services

The Electronic Money Transfer (EMT) service offered by Mauritius Post is a modern, electronic alternative to traditional money orders. It enables quick and secure fund transfers within Mauritius and Rodrigues using our network of computerized counter outlets under Post Global.

Conditions of acceptance

Personal appearance

Acceptance of an EMT is conditional upon the payee personally visiting the paying office for encashment.

Restrictions on use

EMTs cannot be used for transfers to Government Bodies, Banks, Companies, Business Firms, Prisons, Rehabilitation Centres, or Attorneys’ Chambers.

Currency

All transactions (acceptance and payment) are conducted exclusively in Mauritian currency.

Authorized amount

Minimum and Maximum Limits: EMTs can be issued for amounts ranging from Rs 200 to Rs 10,000.

Commission rates

The commission for e-money transfers is structured as follows:

- First Rs 300: Rs 10.00

- Each additional Rs 100 or fraction thereof: Rs 3.00

Validity

An EMT remains valid for one month from the end of the month it was issued.